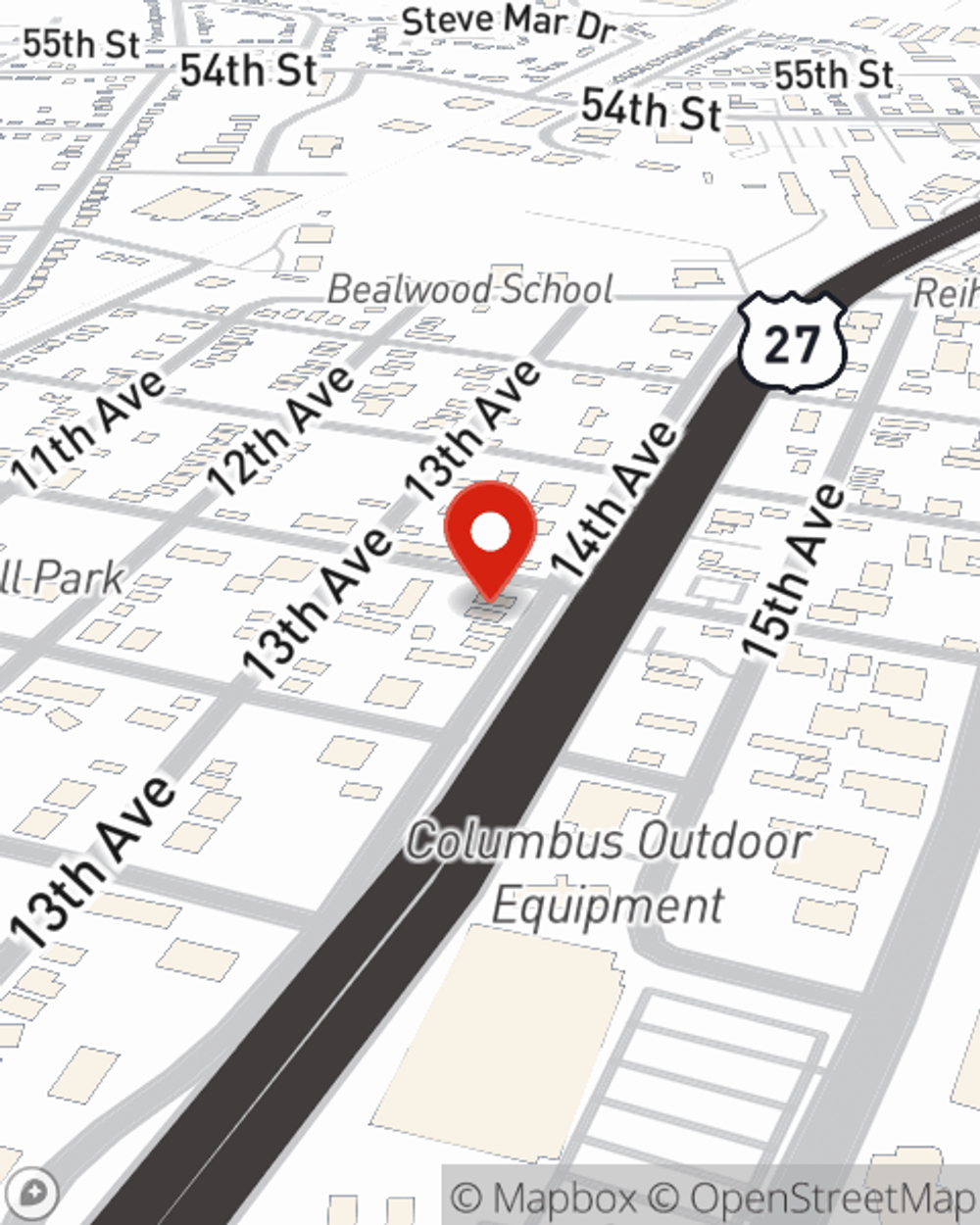

Business Insurance in and around Columbus

Columbus! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Columbus

- Fort Moore

- Phenix City

- Harris County

- Opelika

- Auburn

- Lake Martin

- Lake Harding

- Valley

- LaGrange

- Smiths Station

- Pine Mountain

- Auburn University

- Columbus University

- Beaureguard

- Alexander City

- Dadeville

- Cataula

- West Point

- Eufaula

- Salem

- La Fayette

- Wedowee

- Fort Mitchell

This Coverage Is Worth It.

Owning a business is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for everyone you care for. Because you give your all to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with extra liability coverage, errors and omissions liability and a surety or fidelity bond.

Columbus! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

Whether you own a lawn care service, an ice cream shop or a tailoring service, State Farm is here to help. Aside from great service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Ready to talk through the business insurance options that may be right for you? Get in touch with agent Aaron Warren's office to get started!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Aaron Warren

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.